As one of the most trusted payment providers, PayPal helps grow your business.

Payments built on trust.

Help drive conversion with PayPal.

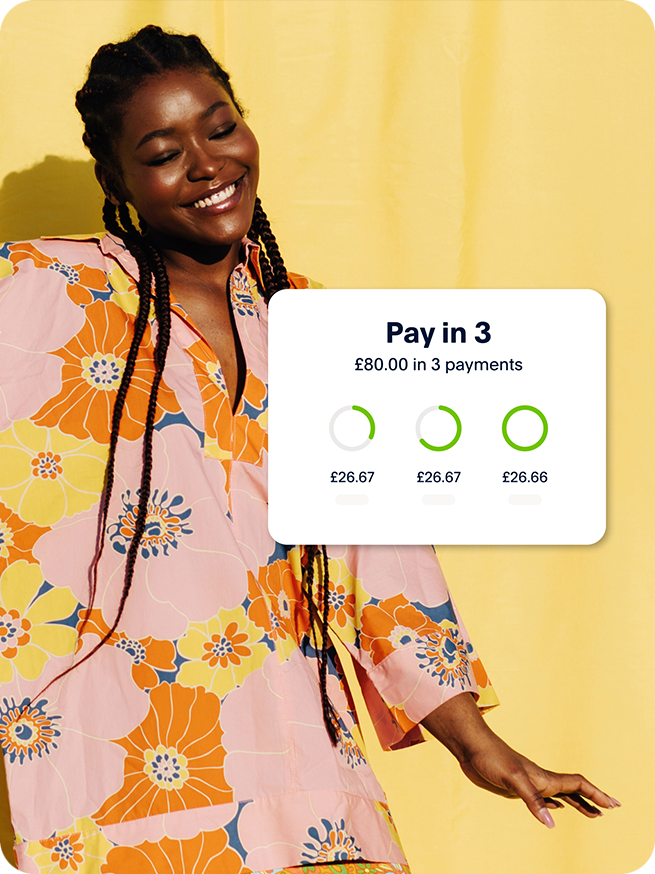

Go ahead, let them pay later.

Go global. Make it local.

Take charge.

- PayPal Checkout: PayPal, Pay Later

- Credit and debit card payments processed right on your site

- Local payment methods used around the world13

- Funds credit immediately into your PayPal business account while payments process

- Save customer billing and shipping info for fast, convenient checkout

- Mobile-friendly so customers can easily shop on any device

- Help drive authorisation rates, reduce declines, and help capture every sale

- Track your transactions from one dashboard

- PayPal helps you handle the risk of fraudulent purchases

- AI-powered technology monitors all transactions

- Seller Protection safeguards PayPal Checkout14

- PayPal solutions help you meet global compliance standards

- Additional security with Fraud Protection on eligible transactions15

Accept payments in-person payments.

- 20+years of experience

- 200+markets around the globe

- 100+different currencies

Simple setup.

See how to activate

- Step 1Login to your osCommerce dashboard.

- Step 2Go to “Settings”.

- Step 3Select “PayPal Checkout”.

- Step 4Once approved and enabled, you can start accepting payments with PayPal.

Not yet using osCommerce?

1 Statista, Global Consumer Survey Brand Report, Online payment: PayPal in the UK, May 2022. Base: n=1,605, online payment users.

2 Pay in 3 availability is subject to merchant status and integration. Consumer eligibility is subject to status and approval. Pay in 3 is a form of credit, may not be suitable for everyone and use may affect consumer's credit scores. See product terms for more details.

3 Nielsen, Commissioned by PayPal, Nielsen Media Behavioural Panel of UK with 14,072 SMB desktop purchase transactions from July 2020 to June 2021. *Checkout conversion - from the point at which customers starts to pay.

4 TRC, Commissioned by PayPal, April 2021. TRC conducted 20 minutes online survey amongst 1,000 UK consumers ages 18+. Base: BNPL Users n=303

5 TRC, Commissioned by PayPal, April 2021. TRC conducted 20 minutes online survey amongst 1,000 UK consumers ages 18+. Base: BNPL Users n=303

6 Based on PayPal internal data from Q1 2022, results include Pay in 3 (UK)

7 See PayPal developer documentation (https://developer.paypal.com/docs/checkout/pay-later/gb/) for the latest availability of Pay Later features and benefits in your region(s)

8 Focus Vision, Commissioned by PayPal. October 2020. The Venmo Behavior Study explores valuable insights for merchants to consider to reach a broader audience including 2,217 Venmo customers' financial habits, purchasing behaviors and perceptions of Venmo as a payments tool.

9 50% of Venmo users are more likely to have a high household income than online payment users overall. Source: Statista Global Consumer Survey as on July 2020. The target population are internet users in U.S. between 18 and 64 years of age.

10 Edison Trends, commissioned by PayPal April 2020 to March 2021. Edison trends conducted a behavioural panel of email receipts from 306,939, US consumers and 3.4+ M purchases at a vertical level between Pay with Venmo and Non-Venmo users during 12-month period.

11 Nielsen, Commissioned by PayPal, Nielsen Media Behavioural Panel of SMB desktop transactions from 3,778 UK PayPal users from July 2020 to June 2021. Q4, 2021, UK

12 Nielsen, Commissioned by PayPal, Nielsen Media Behavioural Panel of SMB desktop transactions from 3,778 UK consumers from July 2020 to June 2021.

13 Availability may vary depending on merchant’s integration method and geographic location.

14 Available for eligible transactions. Limits apply.

15 Available on eligible purchases.

16 Morning Consult - The 15 Most Trusted Brands Globally. March 2021. Morning Consult surveyed over 330,000 consumers across 10 international markets to provide a global view on the current state of consumer trust across brands.